Finance Essentials for Business Success

- Finance & Investment

- Leadership & Management

To use your SkillsFuture Credit, please submit your claim through our payment portal. Do not submit the claim manually via the SkillsFuture page. Please refer to our step-by-step guide here.

1 Day

Who Should Attend

This programme is ideal for business professionals who wish to gain sound financial knowledge quickly and be able to interpret financial information to help them in driving business results.

Overview

To be an all-round successful business professional, sound financial knowledge is essential. Cash flow, in particular, is the lifeline of any business. Upon completion of this highly intensive 1-day programme, you will be able to think of your business / operations in financial terms and equipped with the knowledge to identify the important financial levers that you can use to drive desirable business results. The ability to understand and use financial information is thus, of paramount importance to business success.

Learning Objectives

At the end of the programme, participants would acquire the skills to:

- interpret key financial statements.

- assess the financial health of organisations.

- recognise ‘red flags’ and risks.

- identify events that have the most impact on the company’s cash flow.

- identify potential business opportunities or improvements that enhance organisational value.

Topic/Structure

Programme Outline

- Financial statements overview

– Understand the principles and rules that guide the preparation of financial statements

– Overview of key financial statements and their main components

– Understand the linkages between the various financial statements and their connection to the organisation’s strategy

- Assessing the financial condition of a business and identifying key performance drivers

– Use financial statements to identify an organisation’s performance and vulnerability areas

– Assess the risks in the level of leverage and capital structure

- Managing cash flow

– Identify the difference between net profit and cash flow

– Understand how business decisions and events impact the organisation’s cash flow

– Decide on corrective actions if necessary

- Application

– Analyse a sample financial statement to assess the organisation’s strategy, business performance and potential opportunities / risks

Assessment

Participants have to meet a minimum attendance rate of 75% and have to complete all assessment(s) required by the course. Only upon meeting the minimum attendance and passing the assessment will participants be issued a Certificate of Completion.

Participants who fail the assessment will be given a chance for re-assessment at a fee of SGD100.00 (excluding prevailing GST). Each participant is allowed 1 re-assessment. The re-assessment has to be taken within 7 calendar days from the end of the course date. It will be held on a weekday specified by SMU Academy and conducted during office hours. Please note that re-assessment fees are not supported by SSG Funding.

Participants who meet the minimum attendance rate but do not achieve a pass for the assessment will be issued a Certificate of Participation.

Participants are required to bring their laptop to access the course materials, class exercises and individual assessment(s).

Calculate Programme Fee

Fee Table

| EMPLOYER-SPONSORED | |||

|

PARTICIPANT PROFILE |

SELF-SPONSORED |

SME |

NON-SME |

|

Singapore Citizen < 40 years old Permanent Resident LTVP+

|

$277.95 (After SSG Funding 70%) |

$107.95 (After SSG Funding 70% |

$277.95 (After SSG Funding 70%) |

|

Singapore Citizen ≥ 40 years old |

$107.95 (After SSG Funding 70% |

$107.95 (After SSG Funding 70% |

$107.95 (After SSG Funding 70% |

|

International Participant |

$926.50 (No Funding) |

$926.50 (No Funding) |

$926.50 (No Funding) |

All prices include 9% GST

Please note that the programme fees are subject to change without prior notice.

Post Secondary Education Account (PSEA)

PSEA can be utilised for subsidised programmes eligible for SkillsFuture Credit support. Click here to find out more.

Self Sponsored

SkillsFuture Credit

Singapore Citizens aged 25 and above may use their SkillsFuture Credits to pay for the course fees. The credits may be used on top of existing course fee funding.

This is only applicable to self-sponsored participants. Application to utilise SkillsFuture Credits can be submitted when making payment for the course via the SMU Academy TMS Portal, and can only be made within 60 days of course start date.

Please click here for more information on the SkillsFuture Credit. For help in submitting an SFC claim, you may wish to refer to our step-by-step guide on claiming SkillsFuture Credits (Individual).Workfare Skills Support Scheme

From 1 July 2023, the Workfare Skills Support (WSS) scheme has been enhanced. Please click here for more details.

Employer Sponsored

Enhanced Training Support for SMEs (ETSS)

- Organisation must be registered or incorporated in Singapore

- Employment size of not more than 200 or with annual sales turnover of not more than $100 million

- Trainees must be hired in accordance with the Employment Act and fully sponsored by their employers for the course

- Trainees must be Singapore Citizens or Singapore Permanent Residents

- Trainees must not be a full-time national serviceman

- Trainees are eligible for ETSS funding only if their company's SME status is approved prior to the course commencement date. To verify your SME's status, please click here.

Please click here for more information on ETSS.

Absentee Payroll

Employers who sponsor their employees for the course may apply for Absentee Payroll here. For more information, please refer to:

AP Guide (Non-SME Companies)

Declaration Guide (SME Companies)

Loading schedule information...

*Registration will close 5 calendar days before the course start date, or once the class is full, whichever comes first.

Testimonials

Additional Details

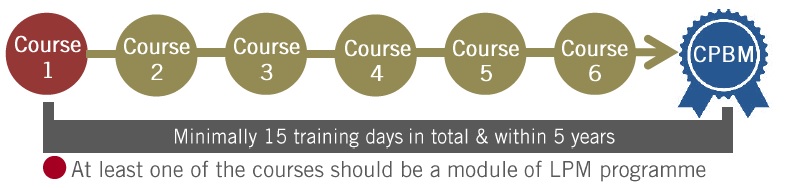

Certified Professional Business Manager (CPBM)

This programme is part of Certified Professional Business Manager. Participants who successfully complete 6 courses/modules with a minimum of 15 training days, from a list of qualifying programmes (terms and conditions apply) within 5 years will receive the Certified Professional Business Manager (CPBM). For example:

Please click here for CPBM details and list of qualifying programmes.