Middle Managers’ Role in Strategy Implementation – The Lynchpin of Success

- Innovation & Business Improvement

- Leadership & Management

To use your SkillsFuture Credit, please submit your claim through our payment portal. Do not submit the claim manually via the SkillsFuture page. Please refer to our step-by-step guide here.

1 Day

Who Should Attend

This course is suitable for supervisors and middle managers who wish to enhance their skills in:

- Translating strategy into day-to-day actions.

- Understanding the impact gen AI is having on middle managers role

- Guiding your team and employees through the transition.

- Identifying and driving the right actions across organizations.

We recommend that you take this 1-day course, and then move on to the complementary 2-day course: Strategic Implementation Toolkit: An Essential Guide for Middle Managers.

Overview

Not enough attention is paid to the role of middle managers in implementing strategy, which contributes to its poor success rate.

Senior leaders are responsible for crafting strategy and middle managers are the lynchpin of success. But they are often ignored.

This course is designed to enhance and reinforce middle managers’ capabilities in translating strategy into the business. It examines how technology is impacting and changing middle managers role. It also provides powerful techniques, tips and a framework to support the middle managers; that is often missing.

The course was initially developed and designed in 2014 as a public offering for Singapore Management University. It continues to be conducted every year due to its popularity, easy to adopt tools and contributing success to assisting organizations in their implementation.

Middle managers in strategy implementation are often called the thermal layer as they absorb both the senior managers inputs and the frontline feedback. They are the lynchpin who translate the strategy into what it means for the frontline and also provide the feedback to senior leaders on the progress being made.

The opening of the course immediately addresses the question that middle managers can influence change and explains how they can do it. The participants then receive six powerful tips that allows them to support and drive the implementation. In the second part of the morning the course examines the relationship between gen AI and then explains the eight areas for excellence in, that make up the Implementation Compass™ framework.

In the afternoon the participants assess themselves in their digital maturity. The majority of the afternoon then focuses on the Harvard listed DBS bank case study, written by the course facilitator.

Topic/Structure

1. How Middle Managers Influence Change

Middle managers can make the difference between success and failure; therefore, ignoring their role in implementing the strategy can be catastrophic. The workshop opens by addressing the question, “Can middle managers influence change and if yes, ‘how’?” It explains how they can create success by using their influence to change attitudes and actions, and emphasizes that it takes small changes, by lots of people that creates big change.

2. Six Tips for Success

Middle managers need to explain to their teams why people should work differently, as by definition a new strategy means working differently. From Bridges’ (the facilitators company) research over the years and their work with clients, six powerful tips have been developed. They include for example, “Less is More”, “Small Actions” and “Give People a Choice”. The tips are explained using research, puzzles, stories and examples.

3. Understanding the Implementation Challenge

A framework is needed to guide people through the implementation journey and identify the right actions. Organizations are guilty of repeating the same mistakes when implementing strategy. This session explains the Gen AI impact and why more implementations fail than succeed. It shares the framework - The Implementation Compass™.

4. Digital Maturity Assessment

Many implementations today involve digitalization. This online assessment allows participants to understand which of the three stages they are at in their digital maturity - Reacting, Embedding or Strategizing. More importantly, immediately upon finishing the assessment they receive a report with recommendations on how they can enhance their digital maturity by reading articles, listening to podcasts or watching videos.

5. Lessons Learned from DBS Case Study

Case studies are an integral part of any participant’s learning. Participants receive the case study as a pre-reading assignment. This final session helps participants learn from DBS Bank about how they implemented their strategy and highlight all the key learning from the of course. Participants share and discuss learning and ideas. They then apply the key lessons to their own organization. DBS bank successfully transformed to the world's best bank by leveraging digitalization. The leaders created a purpose that aligned the whole organization and worked with their middle managers to drive the right actions across every part of the bank.

Assessment

Participants have to meet a minimum attendance rate of 75% and have to complete all assessment(s) required by the course. Only upon meeting the minimum attendance and passing the assessment will participants be issued a Certificate of Completion.

Participants who fail the assessment will be given a chance for re-assessment at a fee of SGD100.00 (excluding prevailing GST). Each participant is allowed 1 re-assessment. The re-assessment has to be taken within 7 calendar days from the end of the course date. It will be held on a weekday specified by SMU Academy and conducted during office hours. Please note that re-assessment fees are not supported by SSG Funding.

Participants who meet the minimum attendance rate but do not achieve a pass for the assessment will be issued a Certificate of Participation.

Participants are required to bring their laptop to access the course materials, class exercises and individual assessment(s).

Calculate Programme Fee

Fee Table

| EMPLOYER-SPONSORED | |||

|

PARTICIPANT PROFILE |

SELF-SPONSORED |

SME |

NON-SME |

|

Singapore Citizen < 40 years old Permanent Resident LTVP+

|

$277.95 (After SSG Funding 70%) |

$107.95 (After SSG Funding 70% |

$277.95 (After SSG Funding 70%) |

|

Singapore Citizen ≥ 40 years old |

$107.95 (After SSG Funding 70% |

$107.95 (After SSG Funding 70% |

$107.95 (After SSG Funding 70% |

|

International Participant |

$926.50 (No Funding) |

$926.50 (No Funding) |

$926.50 (No Funding) |

All prices include 9% GST

Please note that the programme fees are subject to change without prior notice.

Post Secondary Education Account (PSEA)

PSEA can be utilised for subsidised programmes eligible for SkillsFuture Credit support. Click here to find out more.

Self Sponsored

SkillsFuture Credit

Singapore Citizens aged 25 and above may use their SkillsFuture Credits to pay for the course fees. The credits may be used on top of existing course fee funding.

This is only applicable to self-sponsored participants. Application to utilise SkillsFuture Credits can be submitted when making payment for the course via the SMU Academy TMS Portal, and can only be made within 60 days of course start date.

Please click here for more information on the SkillsFuture Credit. For help in submitting an SFC claim, you may wish to refer to our step-by-step guide on claiming SkillsFuture Credits (Individual).Workfare Skills Support Scheme

From 1 July 2023, the Workfare Skills Support (WSS) scheme has been enhanced. Please click here for more details.

Employer Sponsored

Enhanced Training Support for SMEs (ETSS)

- Organisation must be registered or incorporated in Singapore

- Employment size of not more than 200 or with annual sales turnover of not more than $100 million

- Trainees must be hired in accordance with the Employment Act and fully sponsored by their employers for the course

- Trainees must be Singapore Citizens or Singapore Permanent Residents

- Trainees must not be a full-time national serviceman

- Trainees are eligible for ETSS funding only if their company's SME status is approved prior to the course commencement date. To verify your SME's status, please click here.

Please click here for more information on ETSS.

Absentee Payroll

Employers who sponsor their employees for the course may apply for Absentee Payroll here. For more information, please refer to:

AP Guide (Non-SME Companies)

Declaration Guide (SME Companies)

Loading schedule information...

*Registration will close 5 calendar days before the course start date, or once the class is full, whichever comes first.

Testimonials

Additional Details

Certified Professional Business Manager (CPBM)

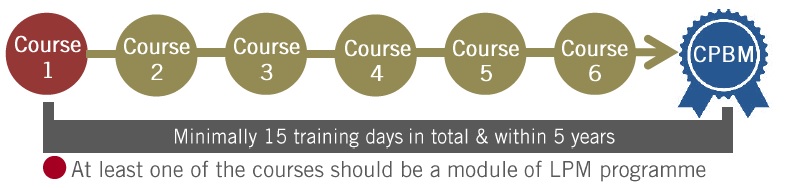

This programme is part of Certified Professional Business Manager. Participants who successfully complete 6 courses/modules with a minimum of 15 training days, from a list of qualifying programmes (terms and conditions apply) within 5 years will receive the Certified Professional Business Manager (CPBM). For example:

Please click here for CPBM details and list of qualifying programmes.