Advanced Certificate in Venture Capital Module 1: Market Overview and Global Perspectives

- Finance & Investment

To use your SkillsFuture Credit, please submit your claim through our payment portal. Do not submit the claim manually via the SkillsFuture page. Please refer to our step-by-step guide here.

2 days

Who Should Attend

Entrepreneurs and business professionals interested to understand how Venture Capitalists (VCs) operate to better prepare or differentiate their companies for investments by VCs.

Finance professionals interested to equip themselves with a comprehensive appreciation of the Venture Capital industry and its practices.

Pre-requisites:

Participants should have at least 2 years of working experience with interest in Venture Capital management/ practices; Tertiary qualifications.

Overview

As of May 2025, Singapore was home to over 2,000 family offices, collectively managing assets exceeding S$100 billion. Notable among these are the family offices of prominent billionaires, including Google Co-Founder Sergy Brin (Bayshore Global Management), Indian tycoon Mukesh Ambani, Chinese entrepreneur Liang Xinjun of Fosun Group, and American hedge fund legend Ray Dalio (Dalio Family Office).

This module provides a comprehensive market overview and a global perspective on the venture capital ecosystem. Through engaging sessions with experienced industry executives, interactive in-class learning activities, and analysis of global case studies, the module emphasizes clear learning objectives and outcomes. Participants will gain practical knowledge and engage in simulated classroom discussions that address real-world challenges in venture capital environments.

Learning Objectives

At the end of the 2-day module, participants will be able to:

- Understand and learn about the global trends in VC and historical development of this industry

- Apply and evaluate the current development of VC industry in view of disruptive technology and a new era of NFTs, DAO, sustainability and quantum computing

- Develop and implement a personal road map with learning goals to continually learn and keep up with this industry over time

- Understand the deal flow processes, recognise the key stakeholders and apply the associated risks and rewards

Topic/Structure

Guest Speakers:

- Ambassador of Mexico to Singapore, H.E. Agustín García-López Loaeza

- Mr Patrick Lim, Chief Executive Officer, Action Community of Entrepreneurship (A.C.E.)

Day 1:

Introduction to Venture Capital:

- Learn global history of venture capital

- Understand different types of companies and business structures in venture capital industry.

- Introduce various stages of venture capital

- Understand the concept of levers in value in venture capital industry.

Understand the basics of Venture Capital Deal Flow:

- Introduce key functions and stakeholders

- Recognize Risk vs Rewards for Venture Investors

- Introduce key functions and stakeholders

Day 2:

- Introduce the megatrends in the global venture capital industry

- Guest speakers to share about the ecosystem and trends caused by disruptive technologies

- A VC Checklist on personal learning: Providing participants with a venture capital knowledge toolkit on enabling personal change in the path to building a road map of continual learning; Identifying personally valuable goals and apply a checklist of seven practical steps as the first step to join the venture capital industry and family offices including personal networking and branding in social media

- Assessment; Closing Debrief and Feedback.

Assessment

There will be presentation or written assessments for each module.

Participants have to meet a minimum attendance rate of 75% and have to complete all assessment(s) required by the course. Only upon meeting the minimum attendance and passing the assessment will participants be issued a Certificate of Completion.

Participants who fail the assessment will be given a chance for re-assessment at a fee of SGD100.00 (excluding prevailing GST). Each participant is allowed 1 re-assessment. The re-assessment has to be taken within 7 calendar days from the end of the course date. It will be held on a weekday specified by SMU Academy and conducted during office hours. Please note that re-assessment fees are not supported by SSG Funding.

Participants who meet the minimum attendance rate but do not achieve a pass for the assessment will be issued a Certificate of Participation.

Participants are required to bring their laptop to access the course materials, class exercises and individual assessment(s).

In order to be awarded with Advanced Certificate in Venture Capital, participants are required to complete all 6 modules (ideally in sequence) within 2 years. Please note that as much as possible, Module 6 should only be attempted after the rest of the modules have been completed.

Calculate Programme Fee

Fee Table

| EMPLOYER-SPONSORED | |||

|

PARTICIPANT PROFILE |

SELF-SPONSORED |

SME |

NON-SME |

|

Singapore Citizen < 40 years old Permanent Resident LTVP+

|

$654 (After SSG Funding 70%) |

$254 (After SSG Funding 70% |

$654 (After SSG Funding 70%) |

|

Singapore Citizen ≥ 40 years old |

$254 (After SSG Funding 70% |

$254 (After SSG Funding 70% |

$254 (After SSG Funding 70% |

|

International Participant |

$2,180 (No Funding) |

$2,180 (No Funding) |

$2,180 (No Funding) |

All prices include 9% GST

Please note that the programme fees are subject to change without prior notice.

Post Secondary Education Account (PSEA)

PSEA can be utilised for subsidised programmes eligible for SkillsFuture Credit support. Click here to find out more.

Self Sponsored

SkillsFuture Credit

Singapore Citizens aged 25 and above may use their SkillsFuture Credits to pay for the course fees. The credits may be used on top of existing course fee funding.

This is only applicable to self-sponsored participants. Application to utilise SkillsFuture Credits can be submitted when making payment for the course via the SMU Academy TMS Portal, and can only be made within 60 days of course start date.

Please click here for more information on the SkillsFuture Credit. For help in submitting an SFC claim, you may wish to refer to our step-by-step guide on claiming SkillsFuture Credits (Individual).Workfare Skills Support Scheme

From 1 July 2023, the Workfare Skills Support (WSS) scheme has been enhanced. Please click here for more details.

Employer Sponsored

Enhanced Training Support for SMEs (ETSS)

- Organisation must be registered or incorporated in Singapore

- Employment size of not more than 200 or with annual sales turnover of not more than $100 million

- Trainees must be hired in accordance with the Employment Act and fully sponsored by their employers for the course

- Trainees must be Singapore Citizens or Singapore Permanent Residents

- Trainees must not be a full-time national serviceman

- Trainees are eligible for ETSS funding only if their company's SME status is approved prior to the course commencement date. To verify your SME's status, please click here.

Please click here for more information on ETSS.

Absentee Payroll

Employers who sponsor their employees for the course may apply for Absentee Payroll here. For more information, please refer to:

AP Guide (Non-SME Companies)

Declaration Guide (SME Companies)

Loading schedule information...

*Registration will close 5 calendar days before the course start date, or once the class is full, whichever comes first.

Testimonials

Additional Details

Programme Registration

Applications will be reviewed by our Programme Admissions Committee. The decision made by the committee is final and no request to review the decision or reveal the considerations leading to the decision would be entertained.

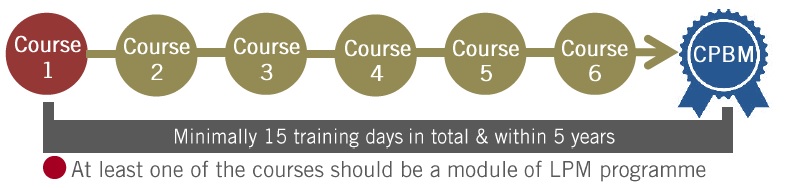

Certified Professional Business Manager (CPBM)

This programme is part of Certified Professional Business Manager. Participants who successfully complete 6 courses/modules with a minimum of 15 training days, from a list of qualifying programmes (terms and conditions apply) within 5 years will receive the Certified Professional Business Manager (CPBM). For example:

Please click here for CPBM details and list of qualifying programmes.