As sustainability becomes a top priority for businesses, Environmental, Social, and Governance (ESG) reporting has taken centre stage in corporate accountability.

ESG reporting refers to the disclosure of data covering a company’s operations in three key areas—environmental stewardship, social responsibility, and corporate governance. It aims to provide stakeholders, including investors, regulators, customers, and employees, with a clearer view of a company’s sustainability risks and opportunities.

In Singapore, ESG reporting is gaining traction as regulators and investors push for more transparency and accountability. Listed companies on the Singapore Exchange (SGX) are already required to publish sustainability reports, and voluntary disclosures are becoming more common across non-listed entities too.

This article will explore the importance of ESG reporting, the regulatory landscape in Singapore, recognised reporting frameworks and standards, how businesses can embark on ESG reporting and common challenges they may face.

Why Does ESG Reporting Matter?

With growing stakeholder expectations and a global shift towards sustainability, ESG reporting has evolved from a peripheral task to a vital business function. It now plays a central role in shaping corporate reputation, guiding investment decisions, and meeting regulatory demands.

Here is why:

- Builds trust with stakeholders: Demonstrates transparency and commitment to responsible business practices

- Supports risk management: Identifies sustainability risks early and enables proactive mitigation

- Attracts investment: Appeals to ESG-conscious investors seeking long-term value and reduced risk exposure

- Enhances regulatory compliance: Ensures alignment with evolving requirements and avoids penalties

- Drives organisational improvements: Promotes efficiency, employee engagement, and stronger governance

Key ESG Areas

ESG reporting is typically structured around three central pillars: Environmental, Social, and Governance. Each pillar captures different aspects of a company’s sustainability performance.

Environmental

The environmental pillar addresses how a company’s activities affect the natural world, especially as global attention on climate change and resource depletion continues to grow.

Key elements include:

- Carbon emissions: Reporting on direct and indirect greenhouse gas (GHG) emissions

- Energy consumption: Disclosure of energy use and efficiency efforts

- Water and waste management: Usage, recycling, and disposal of water and waste

- Biodiversity impact: Measures to protect ecosystems affected by business operations

- Climate resilience: Adaptation strategies for climate-related risks

Social

This pillar focuses on how a company manages relationships with employees, suppliers, customers, and the communities where it operates.

Key elements include:

- Labour practices: Working conditions, diversity and inclusion, and fair wages

- Human rights: Commitment to avoiding human rights violations across the value chain

- Health and safety: Workplace safety protocols and employee well-being

- Community engagement: Contributions to local communities and social initiatives

- Data privacy: Protection of personal data and cyber security practices

Governance

Governance relates to the internal systems, controls, and practices that guide a company’s leadership and decision-making.

Key elements include:

- Board diversity and structure: Composition, independence, and gender balance of the board

- Executive compensation: Alignment of pay with performance and shareholder value

- Ethical conduct: Policies to prevent corruption and conflicts of interest

- Transparency and disclosure: Clear communication of financial and ESG-related information

- Shareholder rights: Fair treatment and engagement of shareholders

ESG Regulatory Landscape in Singapore

The regulatory landscape for ESG reporting in Singapore is shaped primarily by the Monetary Authority of Singapore (MAS) and the SGX. Both entities play a pivotal role in steering businesses towards sustainability disclosures and climate-related transparency. Below are some key regulatory aspects companies should be aware of:

- Mandatory sustainability reporting: SGX mandates listed companies to publish annual ESG reports under a 'comply or explain' rule

- Climate reporting roadmap: MAS and SGX set a roadmap for all listed issuers to adopt mandatory climate reporting by 2025

- Phased approach to climate reporting: Sectors like finance and energy must disclose climate data earlier than others

- Alignment with international standards: Singapore adopts TCFD and ISSB standards to ensure globally aligned ESG disclosures

- ESGenome platform: SGX’s ESG portal simplifies reporting and aligns disclosures with 27 core ESG metrics

- Industry-specific regulations: Sectors like banking face customised guidelines to address sector-specific ESG risks

- Focus on MSMEs: MAS offers toolkits to support smaller firms in building ESG readiness

Key Frameworks and Standards of ESG Reporting in Singapore

There are numerous ESG reporting frameworks and standards used both globally and locally. While frameworks provide principles and guidance on what topics to cover, standards specify what metrics and disclosures to use. Together, they provide a structured approach for companies to develop consistent, transparent, and comparable ESG disclosures.

1. Global Reporting Initiative (GRI)

Developed by: Global Sustainability Standards Board (GSSB)

Purpose: GRI is one of the most widely adopted ESG frameworks globally. It encourages companies to disclose their most material ESG impacts across the economy, environment, and society.

Usage: It supports transparency and comparability across industries and countries, often used by companies to report sustainability performance to a broad set of stakeholders.

2. Sustainability Accounting Standards Board (SASB)

Developed by: Value Reporting Foundation (now part of the IFRS Foundation)

Purpose: SASB provides industry-specific standards focusing on financially material sustainability issues relevant to investors.

Usage: It is especially useful for aligning ESG reporting with investor expectations and is commonly used in conjunction with GRI.

3. International Sustainability Standards Board (ISSB) – IFRS S1 and S2

Developed by: IFRS Foundation

Purpose: ISSB’s IFRS S1 and S2 standards create a global baseline for sustainability-related disclosures and climate-related risks.

Usage: IFRS S1 outlines general sustainability disclosures, while IFRS S2 focuses specifically on climate. These are expected to become key references in global ESG reporting.

4. Task Force on Climate-related Financial Disclosures (TCFD)

Developed by: Financial Stability Board (FSB)

Purpose: TCFD provides recommendations for disclosing climate-related risks and opportunities across four areas: governance, strategy, risk management, and metrics/targets.

Usage: It helps businesses identify and disclose financial impacts of climate change. The SGX mandates climate-related disclosures based on TCFD for selected sectors.

5. SGX Sustainability Reporting

Developed by: Singapore Exchange (SGX)

Purpose: SGX provides a structured sustainability reporting guide for listed companies and recommends a set of 27 core ESG metrics, subject to ongoing review and updates.

Usage: SGX’s approach supports comparability and improves the quality of ESG disclosures for investors and regulators alike.

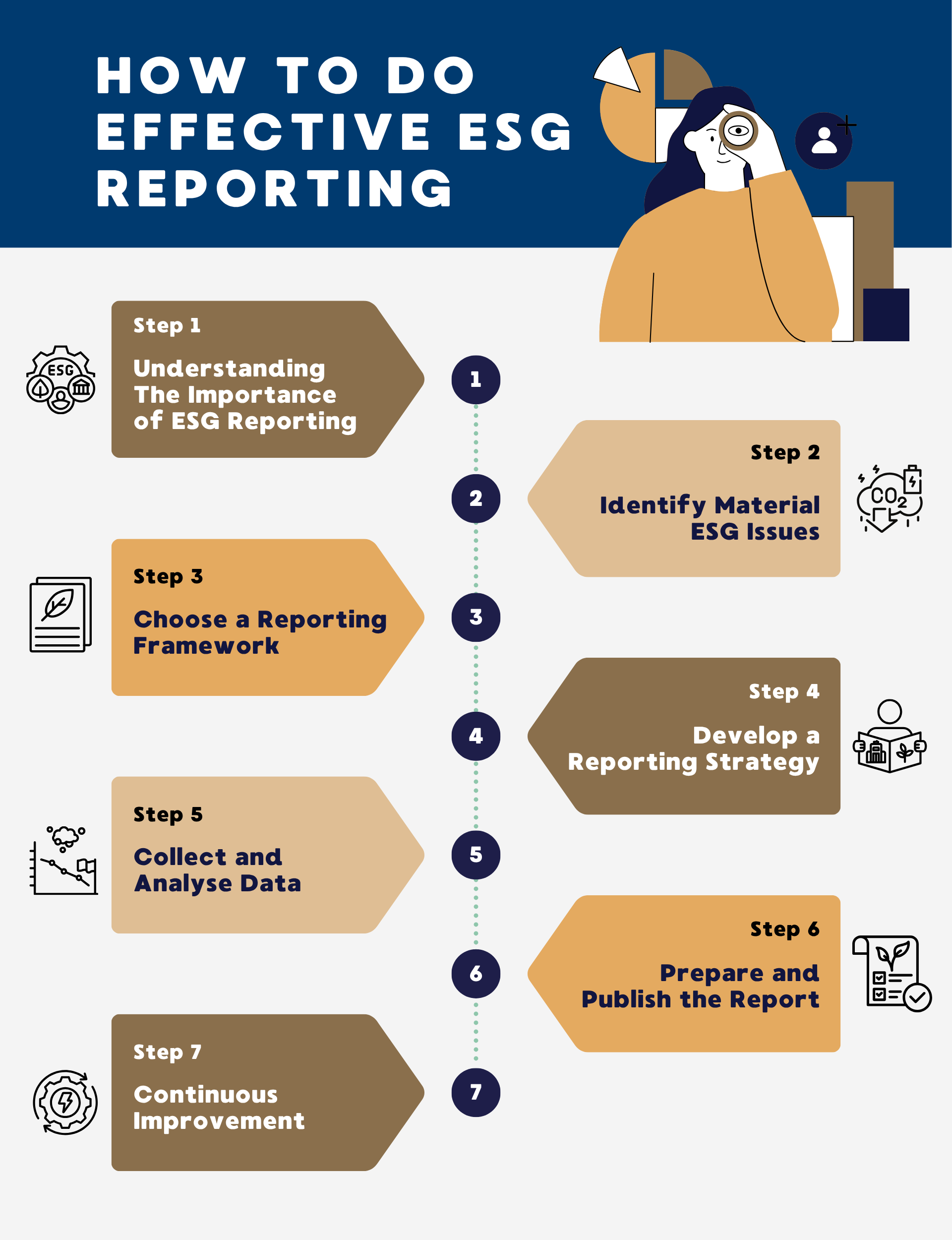

How To Do Effective ESG Reporting

Beginning your ESG reporting journey can seem daunting, but a step-by-step approach can simplify the process and lead to better outcomes. Here is how companies in Singapore can start:

Step 1: Understand the Importance of ESG Reporting

Recognising the value of ESG reporting is the foundation of a successful sustainability strategy. It goes beyond compliance—ESG disclosures demonstrate a commitment to transparency, help attract socially responsible investors, and build long-term trust with stakeholders.

Step 2: Identify Material ESG Issues

Conduct a materiality assessment to determine what ESG topics are most relevant to your organisation and stakeholders. Common issues may include carbon emissions, employee well-being, diversity, cybersecurity, and governance structures. Prioritising material topics ensures the report focuses on what truly matters.

Step 3: Choose a Reporting Framework

Select a reporting framework suited to your industry, size, and goals. For example, GRI is widely used for general disclosures, SASB is investor-focused, and TCFD is climate-specific. Some companies opt to use multiple frameworks to meet diverse stakeholder expectations.

Step 4: Develop a Reporting Strategy

Plan your ESG reporting timeline, assign internal roles, determine reporting scope, and integrate ESG goals with your business strategy. Include governance mechanisms for review and validation to ensure accuracy and credibility.

Step 5: Collect and Analyse Data

Gather reliable ESG data from across departments. Establish clear processes and use technology to automate data tracking where possible. Analysing this data helps identify gaps, set benchmarks, and enhance ESG performance over time.

Step 6: Prepare and Publish the Report

Compile your findings into a coherent, visually engaging report. Highlight achievements, explain challenges, and demonstrate how ESG is embedded in business operations. Publish the report through your corporate website, ESG platforms, and regulator-required portals like ESGenome.

Step 7: Continuous Improvement

Use feedback and data insights to refine your ESG strategy year on year. Stay updated with regulatory changes and emerging stakeholder concerns. ESG reporting should evolve with your organisation's sustainability journey.

Overcoming Common Challenges in ESG Reporting

As ESG reporting becomes more mainstream, companies still encounter roadblocks that can delay or dilute reporting efforts. Understanding these challenges and how to navigate them is essential.

- Data collection difficulties: ESG data is often fragmented or manually tracked

- Possible workaround: Use ESG tracking tools or engage a consultant

- Lack of internal expertise: Many firms lack in-house ESG knowledge or dedicated roles

- Possible workaround: Upskill staff or enrol in ESG training programmes

- Choosing the right framework: The range of ESG frameworks can be confusing and complex

- Possible workaround: Assess business goals and seek expert advice

- Regulatory uncertainty: Shifting ESG disclosure rules can delay decision-making

- Possible workaround: Stay updated through SGX and MAS publications

- Stakeholder misalignment: Differing views on ESG priorities can cause confusion

- Possible workaround: Conduct stakeholder engagement to clarify expectations

Upskill with SMU Academy's ESG Reporting Courses

To support professionals and organisations on their ESG journey, SMU Academy offers a range of practical and strategic sustainability courses that bridge the knowledge gap in sustainability reporting.

1. Environmental, Social, and Governance Mastery: Leading Sustainable Change in Business

This course is ideal for professionals seeking to take a leadership role in driving ESG initiatives within their organisations.

2. Environment, Social and Governance (ESG) and Materiality Reporting

This course is designed for professionals involved in sustainability or compliance functions who want to enhance their understanding of how to identify and report ESG issues effectively.

3. ESG Reporting and Communication

This is designed for ESG practitioners, communications professionals, and sustainability officers who are responsible for preparing and delivering ESG reports.

This module is part of the (SCTP) Advanced Certificate in Driving Sustainability for the Future: The Future of Work through a Sustainable Lens.

This course is tailored for finance and corporate professionals who are looking to apply ESG principles in capital markets and structured finance.

5. Other ESG Reporting Courses

Here are some other courses that are specific to industries like finance and HR:

- Certificate in Environmental, Social, and Governance (ESG) for Professionals in Banking and Finance

- ESG (Environmental, Social and Governance) Strategies for HR (Human Resource) Professionals

Looking Ahead: The Future of ESG Reporting in Singapore

As Singapore continues to strengthen its position as a green finance hub, ESG reporting will only grow in importance. Companies should expect increasing regulatory requirements, deeper investor scrutiny, and more sector-specific guidelines—particularly in climate-sensitive sectors such as finance, agriculture, energy, transportation, materials, and the built environment.

Professionals across industries must be prepared to meet these demands. Upskilling in ESG reporting, governance, and sustainable finance will be essential to stay relevant and competitive in a fast-changing sustainability landscape.

Ready to deepen your ESG knowledge? Explore ESG reporting courses at SMU Academy today.