Investing can potentially allow your money to grow over time by putting it into assets that generate returns or appreciate in value. Many people in Singapore are accustomed to saving their money in a traditional savings account, but the truth is that most savings accounts offer minimal interest that may not even keep up with the rising cost of living. In contrast, investing, when done correctly, can generate significantly higher returns over the years.

It is not necessary to have a large sum of money to begin investing. With the rise of digital platforms, it is now easier than ever to start with small amounts and gradually grow your investment portfolio.

This article will walk you through the key factors to consider before investing, the types of investment options available in Singapore, and a practical step-by-step guide to begin your investing journey.

Note: The information provided in this article is for general informational purposes only and does not constitute professional advice. Readers are encouraged to consider their personal circumstances and consult with a qualified professional before making any decisions.

What to Consider Before You Start Investing

There are many ways to invest and grow your wealth. However, before jumping in, it is important to evaluate a few key factors that will help guide your investment choices.

Investment Goals and Duration

Your investment goals define what you are saving for and when you need the money. Long-term investing, typically over 20 years, is suitable for retirement planning or legacy building. Longer time horizons allow you to take on more risk since there is time to recover from market downturns. Suitable investments include stocks, Exchange-Traded Fund (ETFs), Real Estate Investment Trusts (REITs), and retirement-linked schemes such as the Supplementary Retirement Scheme (SRS).

On the other hand, short-term investing is more appropriate for goals that are just a few years away, such as buying a home, planning a wedding, or taking a sabbatical. Because the investment duration is shorter, you will want more stable and liquid options such as Treasury Bills (T-Bills), Singapore Savings Bonds (SSBs), fixed deposits, or cash management accounts.

Investment Management Style

Every investor has a different approach to managing their investments. You may prefer a more hands-on, active style where you analyse market trends, follow financial news, and make frequent buy and sell decisions. This style suits those who enjoy making their own decisions and have the time to manage their portfolios. Suitable options include individual stocks, cryptocurrencies, and thematic ETFs.

Alternatively, if you prefer a more hands-off approach, you can opt for passive investing. Here, investment decisions are delegated to a financial advisor or an automated platform such as a robo-advisor. Passive investors may prefer instruments like broad-market ETFs, endowment plans, or unit trusts managed by professionals.

Risk Profile

Your risk profile refers to your ability and willingness to handle investment losses. Aggressive investors are open to high-risk, high-return options such as individual stocks, cryptocurrencies, and emerging market funds. They are usually younger or have a longer time horizon, allowing them to ride out market volatility.

Conservative investors, however, prefer low-risk, stable returns and might focus on REITs, government bonds, and savings plans. Regardless of your preference, most financial advisors recommend a balanced approach that combines both growth and safety to create a well-rounded portfolio.

Rate of Returns

When choosing your investments, consider the potential return on each option. Generally, lower-risk investments such as fixed deposits or SSBs yield modest returns of around 2% to 3% per annum. Higher-risk investments, such as equities or crypto, can yield significantly higher returns but come with the possibility of significant losses.

It is important to align your expected rate of return with your financial goals and risk appetite. Aiming for higher returns may be appealing, but it should be tempered with the understanding that higher returns usually come with higher volatility.

Liquidity and Flexibility

Liquidity refers to how easily you can access your money when needed. Investments such as stocks, ETFs, and cryptocurrencies offer high liquidity and can be sold quickly with minimal restrictions. In contrast, endowment plans, fixed deposits, and government bonds may tie up your money for years, with penalties for early withdrawal.

If you expect to need access to your funds in the near future, prioritise investments with higher liquidity and fewer exit restrictions. Also consider any fees or lock-in periods that may affect your ability to redeem your investment.

Types of Investment Options Available

With a wide range of investment instruments in Singapore, it is important to understand how each one works before deciding where to put your money. Each investment vehicle differs in risk, expected returns, duration, liquidity, and the level of management it requires. By learning about the various options available, it is possible to build a diversified investment portfolio that aligns with your personal goals and comfort level.

Cryptocurrencies

Cryptocurrencies are digital assets that rely on blockchain technology to facilitate decentralised and secure transactions. Unlike traditional currencies issued by central banks, cryptocurrencies operate independently of governments and are not regulated by any central authority. The most well-known examples are Bitcoin and Ethereum. These assets can be bought and sold on crypto exchanges and stored in digital wallets. Their prices fluctuate based on demand, investor sentiment, and broader market trends.

Pros: High return potential, highly liquid, decentralised

Cons: Very volatile, unregulated, risk of loss due to scams or hacking

Endowment Plans

Endowment plans are long-term insurance-based savings plans offered by insurers. These plans require regular premium payments over a fixed term, after which the policyholder receives a lump sum payout. The payout typically includes a guaranteed amount and possible non-guaranteed bonuses based on the insurer’s investment performance. Endowment plans often include some protection features such as death or critical illness coverage.

Pros: Low risk, predictable payouts, structured savings

Cons: Long lock-in periods, limited flexibility, lower returns

Exchange-Traded Funds (ETFs)

ETFs are investment funds that track the performance of a market index, sector, or asset class. They are traded on stock exchanges like individual stocks, offering investors exposure to a diversified portfolio with a single purchase. For example, an ETF tracking the Straits Times Index (STI) provides exposure to 30 major Singapore-listed companies. ETFs are typically passively managed and have lower fees than actively managed funds.

Pros: Low cost, diversified, suitable for passive investing

Cons: Subject to market risk, requires basic knowledge of trading platform

Fixed Deposits (FDs)

Fixed deposits are time-bound savings products offered by banks. You deposit a lump sum for a specified period, typically ranging from 1 month to a few years, and earn a fixed interest rate. The principal and interest are returned at the end of the term. FDs are capital guaranteed and insured up to a certain limit under the Singapore Deposit Insurance Corporation (SDIC).

Pros: Very low risk, simple, guaranteed return

Cons: Low yield, lack of flexibility, penalty for early withdrawal

Real Estate Investment Trusts (REITs)

REITs are listed investment vehicles that own, manage, or finance income-generating properties. These properties may include retail malls, office buildings, industrial spaces, or healthcare facilities. REITs are required to distribute most of their income to shareholders as dividends. They allow retail investors to gain exposure to the real estate market without needing to purchase physical property.

Pros: Steady income, property exposure, high liquidity

Cons: Exposed to property market risks, not capital guaranteed

Learn how to analyse a real estate market by signing up for SMU Academy's Professional Certificate in Real Estate Investing course.

Savings Plans

Savings plans are long-term structured products offered by insurance companies to encourage disciplined savings. You make regular contributions over a set term, and the accumulated funds grow at a specified rate. Some plans may offer guaranteed returns while others are linked to market performance. They are commonly used for education funding or milestone goals like weddings or home purchases.

Pros: Encourages saving discipline, some capital protection, low risk

Cons: Limited liquidity, modest returns, early withdrawal penalties

Singapore Government Securities (SGS) Bonds

SGS Bonds are debt securities issued by the Singapore Government to finance public expenditures. These bonds pay a fixed coupon every six months and return the principal at maturity. They are considered virtually risk-free and are suitable for conservative investors looking for predictable income over the medium to long term.

Pros: Very safe, suitable for income-focused investors

Cons: Capital is locked in, interest rate sensitivity

Singapore Savings Bonds (SSBs)

SSBs are a form of SGS designed specifically for retail investors. They offer step-up interest payments over a 10-year period and allow investors to redeem their bonds at any time with no capital loss. SSBs are flexible, low-risk investments that are backed by the Singapore Government.

Pros: Very low risk, flexible, good for beginners

Cons: Limited allocation, lower returns

Singapore Treasury Bills (T-Bills)

T-Bills are short-term government securities with maturities of six or twelve months. They are sold at a discount and pay the full face value at maturity. For example, you may pay S$9,700 for a S$10,000 T-Bill and earn S$300 in return over six months. T-Bills are auctioned every few weeks and require a minimum investment.

Pros: Low risk, short duration, better returns than FDs

Cons: Requires lump-sum capital, not redeemable before maturity

Stocks

Stocks represent ownership in publicly listed companies. When you purchase shares, you become a shareholder and are entitled to dividends if the company distributes profits. Stock prices fluctuate based on company performance, investor sentiment, and broader market conditions. Stocks can be traded on the Singapore Exchange (SGX) or foreign exchanges.

Pros: High return potential, liquid, dividend income

Cons: High volatility, no guarantees, requires active management

Steps to Start Investing for Beginners

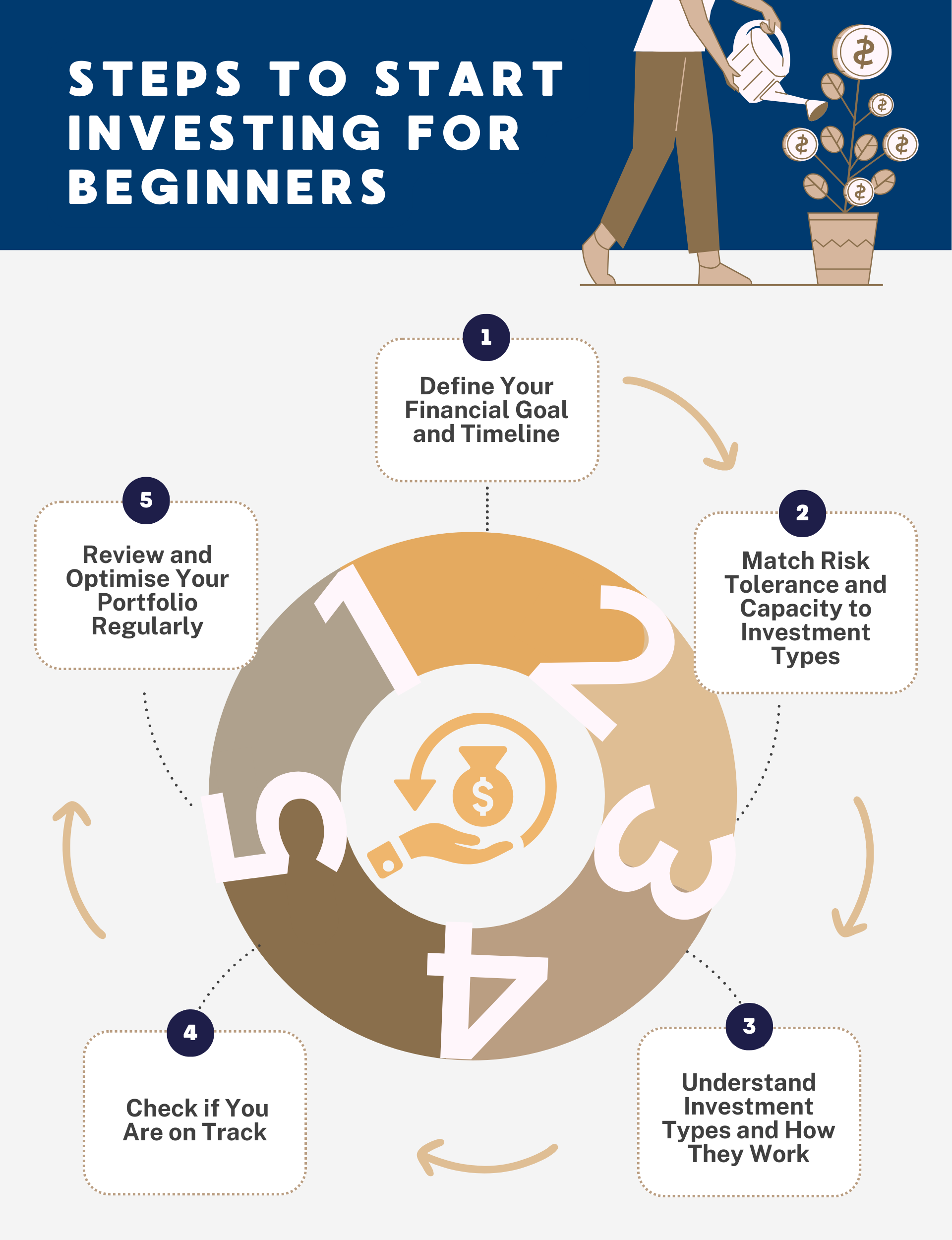

There is no single “correct” way to start investing, but having a clear and structured roadmap can help you avoid common mistakes and build a portfolio that aligns with your personal goals. Every investor starts from a different place. Some have more capital, others more time, while others may have a higher risk appetite. Regardless of your situation, the following five steps can serve as a reliable foundation to guide your investment journey.

Step 1: Define Your Financial Goal and Timeline

The first step is to clearly define what you are investing for. Your goal should be measurable and time-bound to give your investment purpose and direction.

Example: “I want to accumulate S$300,000 by age 65.”

To determine if your goal is achievable, you will need to estimate your Income Replacement Rate (IRR)—the percentage of your pre-retirement income needed to maintain your lifestyle after retirement.

If your current monthly income is S$4,000 and you aim to replace 70% of that, you will need about S$2,800/month in retirement. For a retirement lasting 10 years, that means at least S$336,000 in total to retire comfortably. This helps you work backwards to determine how much you need to invest regularly and what types of investments can get you there.

Step 2: Match Risk Tolerance and Capacity to Investment Types

Before choosing your investments, assess both your risk tolerance and risk capacity.

- Risk tolerance is your psychological comfort level with investment losses or market swings

- Risk capacity is your actual financial ability to absorb those losses without compromising your essential needs

A young investor with no dependents and a stable income may have both high tolerance and capacity, making high-growth investments like stocks and ETFs suitable. A retiree, however, would likely have low capacity and should lean toward safer options like government bonds or savings plans.

Your ideal investment mix should reflect a balance between what you can handle emotionally and what your finances can withstand.

Step 3: Understand Investment Types and How They Work

Now that you have clarity on your goals and risk appetite, it is time to learn about the different investment instruments available. Each type has distinct characteristics in terms of returns, risks, time horizons, liquidity, and management effort.

As outlined in the previous section, options range from safe products like SSBs and fixed deposits to more aggressive investments like stocks and crypto.

Example: A balanced beginner portfolio could look like this:

- 40% in ETFs for long-term growth

- 20% in REITs for income

- 20% in SSBs for safety

- 20% in endowment/savings plans for disciplined saving

This mix provides both stability and growth while keeping liquidity in mind.

Step 4: Check if You Are on Track

After building your portfolio, you need to check whether it is likely to meet your financial goals. Use online calculators or consult a financial advisor to estimate future value based on your contributions and expected returns.

Example: If you are currently 35 years old and want S$300,000 by age 65 (30 years to invest), and you have S$50,000 saved already, you will need to invest about S$350/month at a 5% annual return to reach your goal.

Regularly reviewing this calculation helps you stay accountable and make timely adjustments.

Step 5: Review and Optimise Your Portfolio Regularly

Your financial situation, goals, and market conditions will change over time, so your portfolio should not be static.

It is essential to review your portfolio at least once a year. Are your assets performing as expected? Do your allocations still match your goals and risk tolerance? If not, rebalance accordingly.

As you approach retirement or major life events, you should gradually shift from aggressive growth assets to more conservative, income-generating ones.

Example: A 45-year-old may move from a 70% equities allocation to 50%, increasing their bond or cash holdings to reduce volatility and protect accumulated wealth.

Explore these SMU Academy courses to deepen your investing knowledge:

- Sustainable Investment: The “Why” and the “How”

- Certificate in Value Investing

- Professional Certificate in Digital Finance Investing

- Private Investors' Guide to Bond Investing

Why It Matters to Start Investing Now

Investing can feel daunting at first, especially if you are unfamiliar with financial products or concerned about potential losses. However, doing nothing is also a decision that can have long-term consequences. Keeping your money in a savings account often means losing purchasing power to inflation. Investing, on the other hand, allows your money to grow, multiply, and work harder for your future.

The most important thing is to take action. Start small, stay consistent, and make adjustments as your life changes.

Ready to take your investment journey further? Explore SMU Academy’s range of investing courses and build the foundation for long-term financial success.