Executive Certificate in Blockchain and Digital Assets for Financial Services (Asynchronous E-learning)

- Analytics & Tech

- Finance & Investment

This is an asynchronous e-learning module.

To use your SkillsFuture Credit, please submit your claim through our payment portal. Do not submit the claim manually via the SkillsFuture page. Please refer to our step-by-step guide here.

15 hours of self-paced learning

To be completed within 3 months

Who Should Attend

Professionals including those in Financial Institutions, Governments, Public Sector, Regulators, Corporates, Industry Associations, Tech Companies, Fintech, Support Services and Entrepreneurs needing the skills and knowledge to stay competitive and understand the opportunities, benefits and challenges afforded by blockchain technologies and digital assets as viable solutions for institutional and economic applications.

- Executive and Senior Leaders

- Strategy teams

- Support Functions

- Tech Teams

- Business

PREREQUISITES

Participants should preferably have tertiary qualifications and/or at least 2 years of working experience.

Overview

While the media has been fixated on cryptocurrencies, behind the scenes, institutions have been redefining the very fabric of financial services.

- Central banks are exploring CBDCs, with over 100 of them already working on digital currencies.

- Banks are pioneering bond tokenisation, and the industry is leveraging distributed ledgers for ESG.

- Initiatives like the Canton Network – involving major players such as Goldman Sachs, BNP Paribas, and Microsoft – are just the tip of the iceberg – our experts analysed hundreds of other ones.

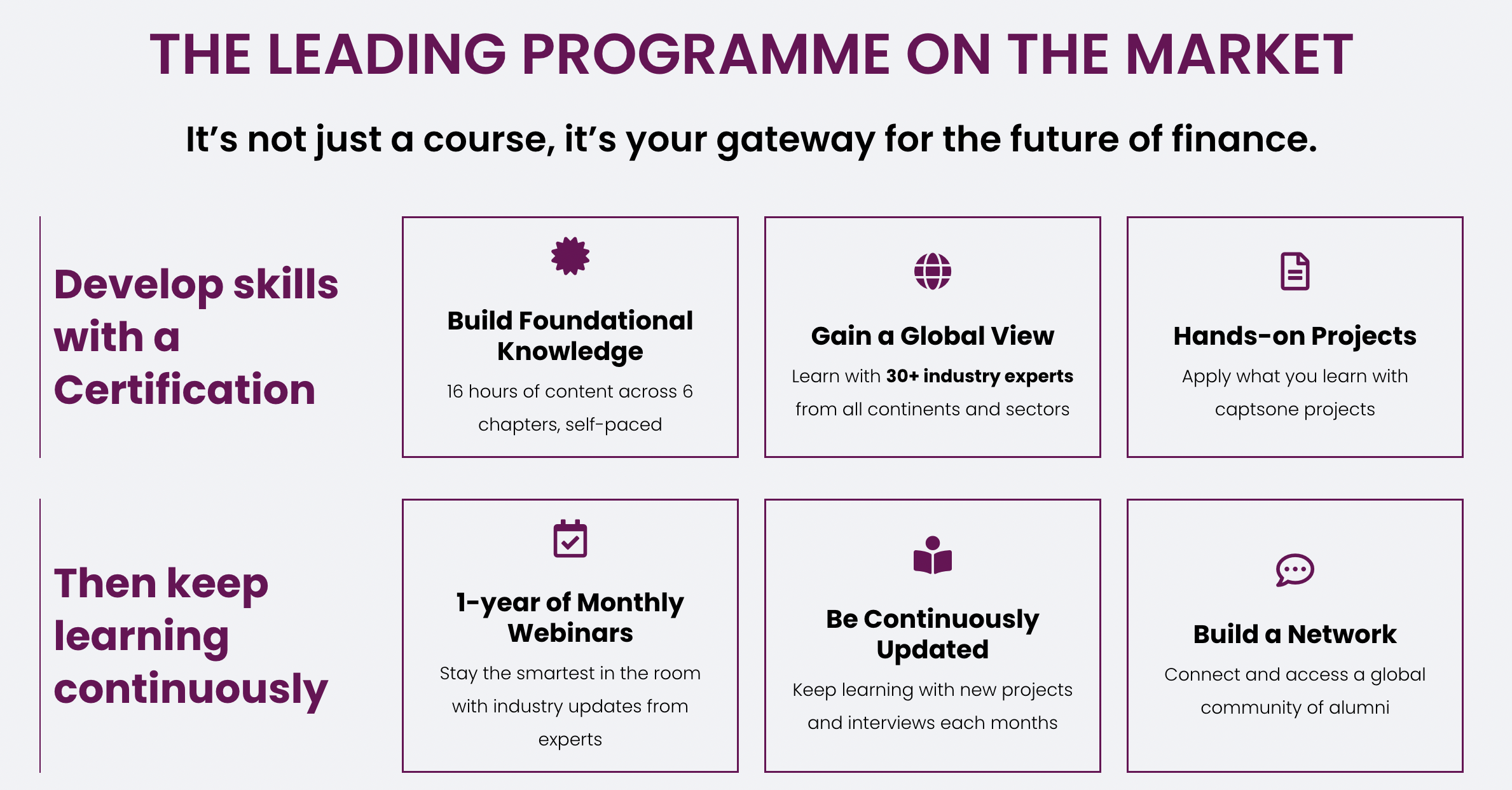

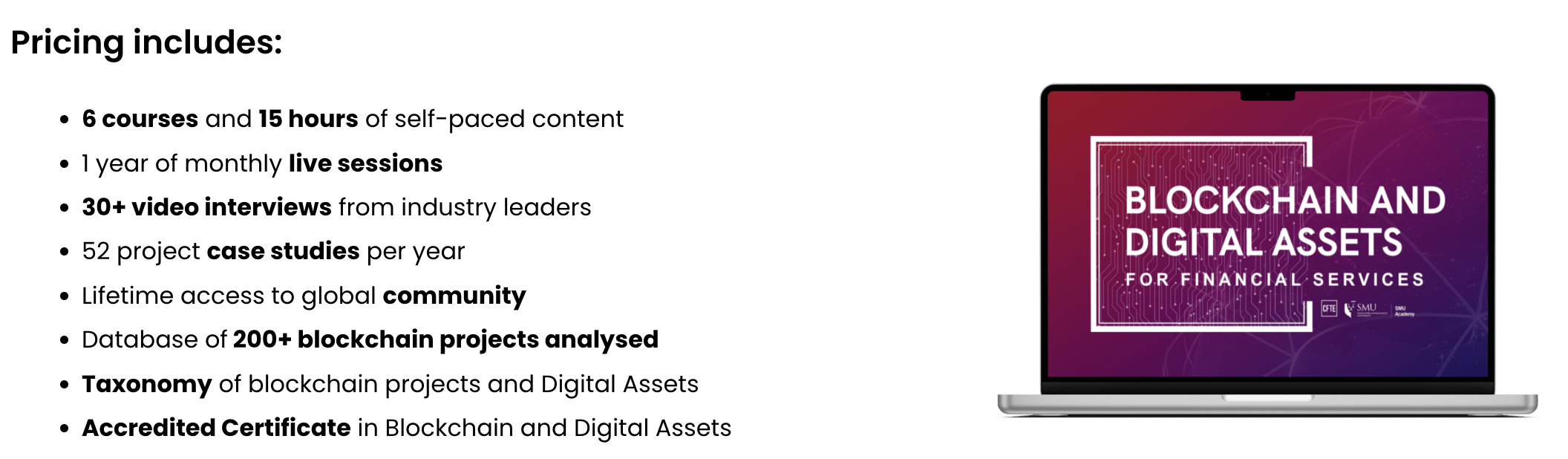

Developed in collaboration with the Centre for Finance, Technology and Entrepreneurship (CFTE – a London-based company and the world’s first Fintech online learning platform), this certificate programme covers the essentials of blockchain and digital assets, providing participants with the skills to transition from traditional finance to a new world of digital finance. Comprising of 6 asynchronous e-learning modules and monthly live sessions, the key objective of this programme is to support participants with a solid, balanced knowledge of what is important, giving learners the foundational knowledge in blockchain technology, new business models and innovation. From this programme, participants will gain a global view on blockchain and digital assets developments and be able to apply this knowledge in their organisations.

Programme Director: Huy Nguyen Trieu

Get an insider's view of the future of finance

- Access 50+ case studies from institutions like HSBC, EIB, Polygon and Goldman Sachs, broken down by industry experts

- Explore more than 200 institutional projects analysed for you

- Learn from 30+ innovators, CEOs, Head of Innovations and Policy-makers

Learn the latest developments in the industry, from those who lead the way.

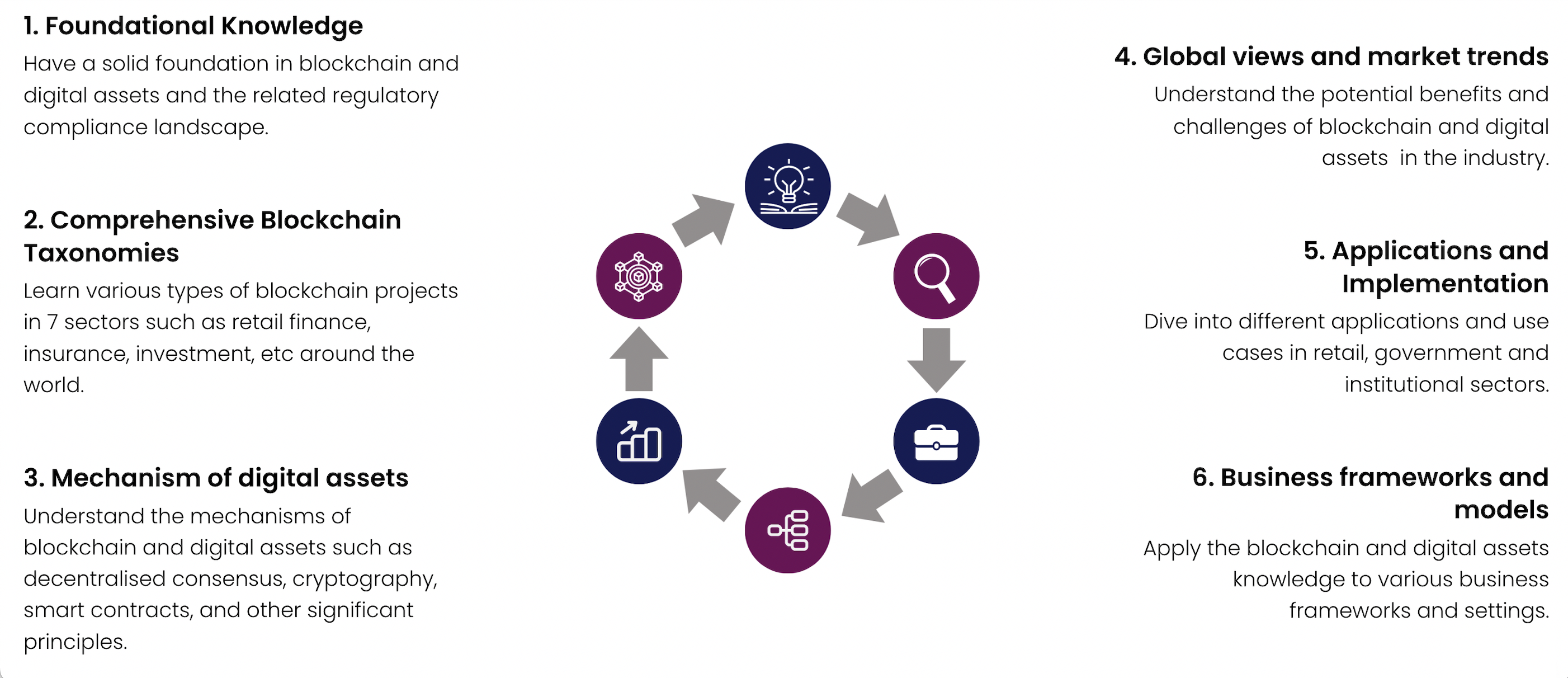

Learning Objectives

Topic/Structure

Chapter 1: Introduction and Overview

Financial institutions like HSBC, Morgan Stanley and Standard Chartered have implemented blockchain technology in their operations and included digital assets as their financial products. What strategy did these companies adopt? How can traditional financial institutions transform their business digitally?

Introduction and Overview of Blockchain and Digital Asset is the first course of the Online Certification Blockchain and Digital Asset for Financial Services Programme – co-developed by CFTE and Singapore Management University – will help you gain a comprehensive understanding of the dominating force of the blockchain and digital assets.

Curriculum

- History of Money, Bitcoin and Blockchain Philosophy

- Digital Finance and Assets: The Evolution and Valorisation

- Web1, Web2 and Web3

- Hybrid Finance (HyFi) - Digital v Traditional

- Global Taxonomy of Projects

Learning Outcomes

- Understanding the fundamentals of blockchain, including its history, architecture and how it works

- Gain knowledge of digital finance and assets and how they have evolved over time

- Explore the difference between traditional finance and digital finance, including their advantages and disadvantages

- Discover a global use cases of blockchain and digital assets in different sectors

Chapter 2: DLT and Blockchain

Blockchain technology is an essential component of the Distributed Ledger Technologies (DLT) ecosystem. Understanding the functions of DLT and the logic of blockchain is an important step to thrive in the world of digital finance.

DLT and Blockchain is the second course of the Online Certification Blockchain and Digital Asset for Financial Services Programme – co-developed by CFTE and Singapore Management University – will help you gain a comprehensive understanding of the Distributed Ledger Technologies (DLT) ecosystem.

Curriculum

- Centralised and Distributed Ledger Technologies

- Blockchain

- System Tokenomics

- Smart Contracts

- Digital Identities, Verifiable Credentials and Privacy

Learning Outcomes

- Understand how DLT technology can impact on the security, transparency and efficiency

- Develop an understanding of system tokenomics in the blockchain ecosystem

- Learn about smart contracts and their use cases

- Explore digital identities, credentials and privacy in the context of blockchain technology

Chapter 3: Fundamentals of Digital Assets

The global digital asset management market is expected to expand from USD 4.2 billion in 2022 to USD 8.0 billion by 2027. Large financial institutions such as HSBC, Morgan Stanley and Standard Chartered are involved in this digital transformation.

Fundamentals of Digital Assets is the third course of the Online Certification Blockchain and Digital Asset for Financial Services Programme – co-developed by CFTE and Singapore Management University – will help you gain a comprehensive understanding of digital assets and its future trends.

Curriculum

- Taxonomy of Digital Assets

- Wallets, KYC and AML

- Centralised Finance (CeFi)

- Decentralised Finance (DeFi) and Hybrid Models

- Crypto Asset Consumers

Learning Outcomes

- Understand the objective and purpose of different digital assets

- Discover how digital assets can enhance compliance and risk management in Finance

- Learn about trading strategies, forecasts and trends related to digital assets

- Explore the advantages, limitations and impacts of CeFi, DeFi, CeDeFi and ReFi

Chapter 4: Institutional Applications - Taxonomy Part 1

Blockchain now is moving from a retail to an institutional world, with increasing implementations from central banks or organisations. Financial institutions like HSBC, Morgan Stanley and Standard Chartered have implemented blockchain technology in their operations and included digital assets as their financial products.

Institutional Applications – Taxonomy Part 1, is the fourth course of the Online Certification Blockchain and Digital Asset for Financial Services – co-developed by CFTE and Singapore Management University – will help professionals to learn real-world applications of blockchain and digital assets.

Curriculum

- Asset Tokenisation

- Transforming the Value Chain in Finance

- Custodian Services

- Cross-border Payments and Settlements

- Insurance

Learning Outcomes

- Gain knowledge of blockchain real-world applications in financial industries

- Gain an understanding of tokenisation and asset management

- Learn about how banking, credit and capital sectors incorporate blockchain technology

- Learn about the mechanism of cross-border transactions

- Explore the applications of insurance in the context of digital assets

Chapter 5: Infrastructure and New Paradigm Applications - Taxonomy Part 2

Blockchain technology is enabling new business models and disrupting traditional finance industries. Almost half of the top 100 public companies are using blockchain amid growing institutional adoption.

Infrastructure and New Paradigm Applications – Taxonomy Part 2 is the fifth course of the Online Certification Blockchain and Digital Asset for Financial Services Programme – co-developed by CFTE and Singapore Management University – will help you gain a comprehensive understanding of the new paradigm applications in blockchain.

Curriculum

- New Business Models

- Trade and Supply Chain

- ESG and Sustainability

- Government and Public Sector

- Healthcare and Humanitarian

Learning Outcomes

- Understand why large financial institutions are rushing to develop strategies for adopting blockchain in operations

- Discover how blockchain can facilitate ESG and Sustainability

- Learn how the Government and Public Sector can leverage the opportunities of adopting blockchain and digital assets in the current system

- Evaluate how blockchain can be a catalyst for digital transformation in Healthcare and Humanitarian

Chapter 6: Governance, Due Diligence and Risk - Taxonomy Part 3

Financial institutions like HSBC, BNP Paribas and Standard Chartered have implemented blockchain technology in their compliance system. Blockchain technology has the potential to provide numerous benefits to the organisations, including the ability to mitigate risk and have better data management.

Governance, Due Diligence and Risk – Taxonomy Part 3 is the final course of the Online Certification Blockchain and Digital Asset for Financial Services Programme – co-developed by CFTE and Singapore Management University – will help you gain a comprehensive understanding of the dominating force of the blockchain and digital assets.

Curriculum

- Mindset, Education and Information Authentication

- Compliance, Regulation and Risk

- Cybersecurity and Exploits

- Corporate Governance and Support

- Project Failures: Why and What We Have Learnt?

Learning Outcomes

- Understand the need for regulatory oversight and compliance of financial services

- Gain knowledge on how to identify and mitigate cybersecurity risks

- Develop a growth mindset and learn how to deal with project failure in this ever-changing industry

Assessment

As part of the requirement for IBF-STS accredited courses, there will be an assessment in the form of Multiple Choice Questions conducted at the end of the programme.

Participants are required to complete the programme and pass the associated assessment in order to be awarded the digital Certificate of Completion issued by SMU Academy.

Fee Table

PARTICIPANT PROFILE | SELF-SPONSORED | EMPLOYER-SPONSORED |

Singapore Citizen < 40 years old Permanent Resident | $7081 | $7081 |

Singapore Citizen ≥ 40 years old | $4682 | $4682 |

International Participant | $1,308 (No Funding) | $1,308 (No Funding) |

All prices include 9% GST

1 50% IBF-STS funding for Singapore Citizens and Permanent Residents physically based in Singapore from eligible Financial Institutions and Fintech firms

2 70% IBF-STS funding for Singapore Citizens aged 40 years old and above physically based in Singapore from eligible Financial Institutions and Fintech firms

GST component is not included in funding.

For more information, you may refer to this link.

Note: Fees may be subject to change, according to prevailing funding terms and conditions from the Institute of Banking and Finance Singapore (IBF)

Please note that the programme fees are subject to change without prior notice.

IBF - STS Funding

Standards Training Scheme

The IBF Standards Training Scheme (IBF-STS) provides funding for training and assessment programmes accredited under the Skills Framework for Financial Services. It is applicable for both Company-Sponsored and Non Company-Sponsored individuals.

For training programmes commencing from 1 Jan 2023:- Individuals must be physically based in Singapore.

- Singapore Citizens and PRs will be eligible for 50% funding of direct training cost.

- Singapore Citizens aged 40 years old and above will be eligible for 70% co-funding of direct training cost.

- Funding amount is capped at S$3,000 per participant per course.

- Course fees subsidies will not apply to self-sponsored individuals who are not employed by financial institutions and Singapore FinTech Association certified FinTech firms for critical core skills (generic /soft skills) and future-enabled skill only courses.

- Trainees are only eligible for a one-time grant of course fee subsidies for the course per calendar year, subject to their successful completion of the course.

Click here for more details.

Loading schedule information...

*Registration will close 5 calendar days before the course start date, or once the class is full, whichever comes first.