Advanced Certificate in Venture Capital Module 2: Investment Strategies, Framework and Techniques

- Finance & Investment

To use your SkillsFuture Credit, please submit your claim through our payment portal. Do not submit the claim manually via the SkillsFuture page. Please refer to our step-by-step guide here.

2 days

Who Should Attend

Entrepreneurs and business professionals interested to understand how Venture Capitalists (VCs) operate to better prepare or differentiate their companies for investments by VCs.

Finance professionals interested to equip themselves with a comprehensive appreciation of the Venture Capital industry and its practices.

Pre-requisites:

Participants should have at least 2 years of working experience with interest in Venture Capital management/ practices; Tertiary qualifications.

Overview

A successful venture capitalist (VC) needs years of training and honing of practical skills to be successful. Exposure and knowledge of a wide variety of industries, sectors and understanding of different business structures are also critical to aid them in the identification of opportunities and construction of investment strategies.

Building on the knowledge acquired in Module 1, this 2-day module aims to introduce participants to the different investment strategies, techniques and framework used by VCs and family offices.

Learning Objectives

At the end of the 2-day module, participants will be able to:

- Learn and implement the key investment criteria and considerations adopted by VCs in assessing investment deals

- Apply and reflect, through a case study, individual biases and blind spots during evaluation of new investments

- Appreciate basic portfolio management plans and regulatory and risk assessment

- Implement a toolkit to assess the founders’ team and investment framework

Topic/Structure

Guest Speaker:

Mr Seng Woei Yuan, Director (Industry), Technology Cluster, MP International

Day 1:

Introduction to key criteria to investment:

- Founders’ Profile and Founders’ assessment

- Portfolio Management Plan

- Regulatory & Risk Assessment

- An overview of the framework and component of different types of market sizing and tools available

- Introduce a basic toolkit to assess founders’ team and investment framework

- Create a self-exercise and class room discussion

Learn and apply key criteria to investment:

- Value Creation; Synergy; Risk Mitigation; Exit Strategies; Understand the framework of value creation

- Guest speakers to share the framework of value creation and investment value

Day 2:

Appreciate and apply the VC deal flow process:

- Review and summarize the strategies and techniques to source for quality deals

- Understand, apply and gain insights to what makes a good deal for VC

- Conduct a self-exercise to execute a case study to provide personal insights and reflection to raise their quality and quantity of deal flow in venture capital industry.

Implement a VC Toolkit on investment framework and strategies:

- Review with participants with a holistic framework to identify key criteria to identify good investment deals and good founder team in the global stage

- Assessment; Closing Debrief and Feedback

Assessment

There will be presentation or written assessments for each module.

Participants have to meet a minimum attendance rate of 75% and have to complete all assessment(s) required by the course. Only upon meeting the minimum attendance and passing the assessment will participants be issued a Certificate of Completion.

Participants who fail the assessment will be given a chance for re-assessment at a fee of SGD100.00 (excluding prevailing GST). Each participant is allowed 1 re-assessment. The re-assessment has to be taken within 7 calendar days from the end of the course date. It will be held on a weekday specified by SMU Academy and conducted during office hours. Please note that re-assessment fees are not supported by SSG Funding.

Participants who meet the minimum attendance rate but do not achieve a pass for the assessment will be issued a Certificate of Participation.

Participants are required to bring their laptop to access the course materials, class exercises and individual assessment(s).

In order to be awarded with Advanced Certificate in Venture Capital, participants are required to complete all 6 modules (ideally in sequence) within 2 years. Please note that as much as possible, Module 6 should only be attempted after the rest of the modules have been completed.

Calculate Programme Fee

Fee Table

| EMPLOYER-SPONSORED | |||

|

PARTICIPANT PROFILE |

SELF-SPONSORED |

SME |

NON-SME |

|

Singapore Citizen < 40 years old Permanent Resident LTVP+

|

$654 (After SSG Funding 70%) |

$254 (After SSG Funding 70% |

$654 (After SSG Funding 70%) |

|

Singapore Citizen ≥ 40 years old |

$254 (After SSG Funding 70% |

$254 (After SSG Funding 70% |

$254 (After SSG Funding 70% |

|

International Participant |

$2,180 (No Funding) |

$2,180 (No Funding) |

$2,180 (No Funding) |

All prices include 9% GST

Please note that the programme fees are subject to change without prior notice.

Post Secondary Education Account (PSEA)

PSEA can be utilised for subsidised programmes eligible for SkillsFuture Credit support. Click here to find out more.

Self Sponsored

SkillsFuture Credit

Singapore Citizens aged 25 and above may use their SkillsFuture Credits to pay for the course fees. The credits may be used on top of existing course fee funding.

This is only applicable to self-sponsored participants. Application to utilise SkillsFuture Credits can be submitted when making payment for the course via the SMU Academy TMS Portal, and can only be made within 60 days of course start date.

Please click here for more information on the SkillsFuture Credit. For help in submitting an SFC claim, you may wish to refer to our step-by-step guide on claiming SkillsFuture Credits (Individual).Workfare Skills Support Scheme

From 1 July 2023, the Workfare Skills Support (WSS) scheme has been enhanced. Please click here for more details.

Employer Sponsored

Enhanced Training Support for SMEs (ETSS)

- Organisation must be registered or incorporated in Singapore

- Employment size of not more than 200 or with annual sales turnover of not more than $100 million

- Trainees must be hired in accordance with the Employment Act and fully sponsored by their employers for the course

- Trainees must be Singapore Citizens or Singapore Permanent Residents

- Trainees must not be a full-time national serviceman

- Trainees are eligible for ETSS funding only if their company's SME status is approved prior to the course commencement date. To verify your SME's status, please click here.

Please click here for more information on ETSS.

Absentee Payroll

Employers who sponsor their employees for the course may apply for Absentee Payroll here. For more information, please refer to:

AP Guide (Non-SME Companies)

Declaration Guide (SME Companies)

Loading schedule information...

*Registration will close 5 calendar days before the course start date, or once the class is full, whichever comes first.

Testimonials

Additional Details

Programme Registration

Applications will be reviewed by our Programme Admissions Committee. The decision made by the committee is final and no request to review the decision or reveal the considerations leading to the decision would be entertained.

Certified Professional Business Manager (CPBM)

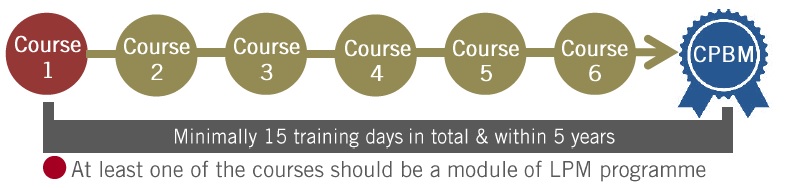

This programme is part of Certified Professional Business Manager. Participants who successfully complete 6 courses/modules with a minimum of 15 training days, from a list of qualifying programmes (terms and conditions apply) within 5 years will receive the Certified Professional Business Manager (CPBM). For example:

Please click here for CPBM details and list of qualifying programmes.